Ocado's Seven-Minute Arbitrage Opportunity

| 3 min readOcado is a UK-listed grocery technology company that sells Customer Fulfillment Centres (“CFCs”, and it’s a British company, so we’ll spell centre like this) to grocery chains worldwide. These centres are essentially large warehouses with some automation and fulfillment technology that allow grocers to offer grocery delivery to their customers without developing the necessary warehouse and fulfillment technology and infrastructure. Ocado also has an online grocery business in the UK.

One of Ocado’s clients is Sobeys, a Canadian grocery chain, and its e-commerce brand Voilà. Sobeys is owned by Empire, a Canada-listed company. Ocado and Empire jointly announced a deal in May 2019 worth CAD 95mn (~USD 70mn, GBP 56mn at the time of closing).

Five years later, in May 2024, the companies fell out, and Sobeys decided to terminate its relationship with Ocado. It announced this to the public in its FY 2024 results1 published on June 20th.

In line with normal procedures, Sobeys’ parent Empire announced its results before the market opened at 6.30 a.m. Eastern time. However, 6.30 a.m. Eastern time is 11.30 a.m. BST, in the middle of the trading day for UK-listed Ocado.

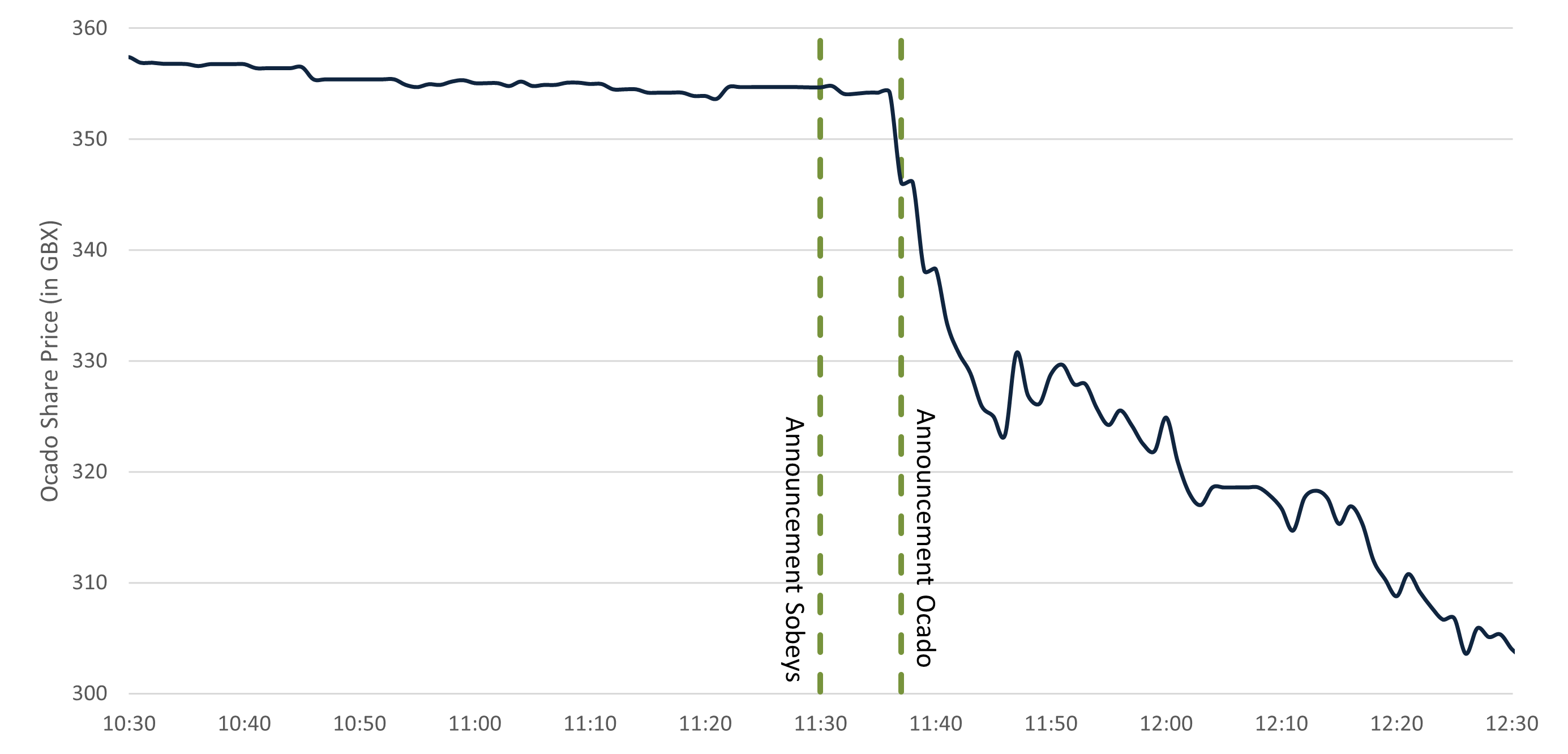

Losing the Sobeys contract is material news for Ocado, as evidenced by the fact that the company’s share price dropped by 11.7% on the day of the announcement. Thus, the company felt compelled to issue its own press release shortly after Empire’s results .

However, rather than starting its drop at 11.30 a.m. BST when Empire’s release hit the wires, Ocado’s share price started dropping only seven minutes later, at around 11.37 a.m. BST.

How come? Ocado’s own update was only published at 11.37 a.m. BST, presumably as a result of some coordination challenges rather than malfeasance. During those seven minutes, investors in the UK hadn’t incorporated the new information disclosed in Canada by one of the company’s customers. A shrewd investor who can quickly correlate such new information would have found a very attractive trade.

This appearance of a massive information arbitrage opportunity in a well-followed stock is a stark example that (a) dissecting information from company press releases can still yield attractive short-term trading opportunities, and (b) any systematic approach to these situations needs better and differentiated technology.

Footnotes

-

Being a grocery business, the company has a rather odd financial year, terminating on the first Saturday in May of each year. Costco ($COST) follows a similar convention requiring analysts to consult a calendar to determine when the companies’ respective financial year ends. ↩

Alex is the co-founder and CEO of Marvin Labs. Prior to that, he spent five years in credit structuring and investments at Credit Suisse. He also spent six years as co-founder and CTO at TNX Logistics, which exited via a trade sale. In addition, Alex spent three years in special-situation investments at SIG-i Capital.