The Questions on NVIDIA's 2Q25 Earnings Call: A Follow-Up

| 11 min readNVIDIA released its 2Q25 earnings results yesterday, surpassing expectations and revising its guidance upwards. The press release, the filing, and the transcript of the earnings call are available on the MarvinLabs app. Despite the initial market reaction, with the stock dipping nearly 8% in after-hours trading, it demonstrated resilience by bouncing back almost 5% in early trading on Thursday

In a sign of unreal expectations for the company, the Financial Times commented on the results, saying: "However, Nvidia’s outlook for the current quarter fell shy of the most ambitious forecasts from analysts who have become accustomed to runaway results from the chipmaker." Financial Times, August 29, 2024

The Earnings Call

Yesterday, we looked at the questions asked by analysts on NVIDIA's earnings calls over the last five quarters (ending in 1Q25). Let's take a look at the questions asked on the call today. We are presenting the "no fluff, concise" version of the question. Hover over the questions or check out the verbatim version of the MarvinLabs app.

Jensen, you mentioned a change in the Blackwell GPU mask. Are there any other incremental changes in back-end packaging or anything else? You suggested shipping several billion of Blackwell in Q4 despite the design change. Will these issues be resolved? What is the overall impact of these changes on Blackwell timing, revenue profile, and customer reactions?

Advanced Packaging and Vertical Integration Product Roadmap and R&D Production and Shipment Timing

What metrics does NVIDIA monitor to gauge customer return on investment and its impact on CapEx sustainability? Additionally, what factors are driving the improved outlook for Sovereign AI, and how should we think about fiscal 2026?

Customer Investment and ROI Market and Revenue Impact Revenue Growth Projections

How long do you anticipate strong demand for both Hopper and Blackwell? Can you discuss the transition to Blackwell and whether clusters will intermingle or if Blackwell will primarily be used for new clusters?

Product Deployment and Demand Demand and Transition Management

Can you clarify the priorities and timeframes of customers investing in new technology, specifically those pushing towards AGI Convergence versus those focused on CapEx versus ROI?

Customer Investment and ROI

Can you discuss the shape of revenue growth both near and long term, considering the increase in OpEx and bullish purchase commitments? Specifically, how will customer readiness for liquid cooling and the ramp of Blackwell impact this? Additionally, looking beyond next year into 2026, are there concerns about factors like the power supply chain or model size reduction?

Revenue Growth Projections Market and Revenue Impact Power Supply Chain and Model Size

Is the first several billion of Blackwell revenue in Q4 additive? Does Hopper demand strengthen from Q3 to Q4 on top of Blackwell's addition? For gross margins, if I have mid-70s for the year, should I expect around 71-72 for Q4? What are the drivers of gross margin evolution into next year as Blackwell ramps?

Demand and Transition Management Gross Margins Revenue Growth Projections

Can you explain the geographic revenue dynamics, particularly why the U.S. was down sequentially while several Asian regions, including China, were up significantly? Also, does this imply that the company's overall sequential revenue growth rates will accelerate in Q4?

Market and Revenue Impact Revenue Growth Projections

How does the increasing complexity and advanced packaging challenges affect your approach to vertical integration, supply chain partnerships, and your margin profile?

Gross Margins Advanced Packaging and Vertical Integration

How do you see the rack scale system mix dynamic in the Blackwell product cycle, particularly with leveraging NVLink?

NVLink and Rack Scale Systems

How do these questions stack up historically?

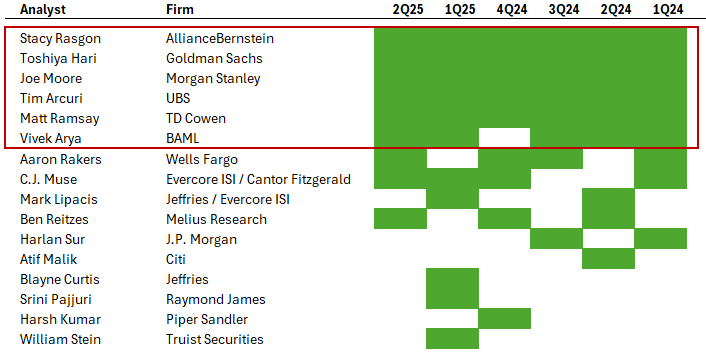

First, regarding the analysts asking the questions, there were no newcomers on the call. The core group of six analysts who asked questions on almost each of at least the last 18 months of NVIDIA earnings calls got their question in again. The core group consists of:

- Stacy Rasgon of AllianceBernstein

- Toshiya Hari of Goldman Sachs

- Joe Moore of Morgan Stanley

- Tim Arcuri of UBS

- Matt Ramsay of TD Cowen

- Vivek Arya of BAML

In addition to those six analysts, Aaron Rakers of Wells Fargo, C.J. Muse of Evercore ISI, and Ben Reitzes of Melius Research asked questions on the call.

In terms of topics, the following dominated:

- Continued The upcoming introduction of Blackwell, the successor to Hopper, and the transition to the new product.

- Continued Color from customer interactions and the outlook for the company's AI business.

- Continued Insights into the company's business in China.

- New Impact of NVLink on the Blackwell product cycle.

With NVIDIA's highly anticipated introduction of the Blackwell GPU architecture - the successor to the company's successful Hopper architecture - on the horizon, it's no surprise that the majority of questions on the call were about this new product.

Similarly, analysts want to get as much read across from NVIDIA's earnings to the CapEx of other major tech players such as META, Google, and Amazon, who are the primary buyers of NVIDIA's products.

What did you think of the call? You can find the press release, the filing, and the transcript of the earnings call on the MarvinLabs app for free if you want to go down in the weeds. You will also find the company's previous calls there.

Alex is the co-founder and CEO of Marvin Labs. Prior to that, he spent five years in credit structuring and investments at Credit Suisse. He also spent six years as co-founder and CTO at TNX Logistics, which exited via a trade sale. In addition, Alex spent three years in special-situation investments at SIG-i Capital.